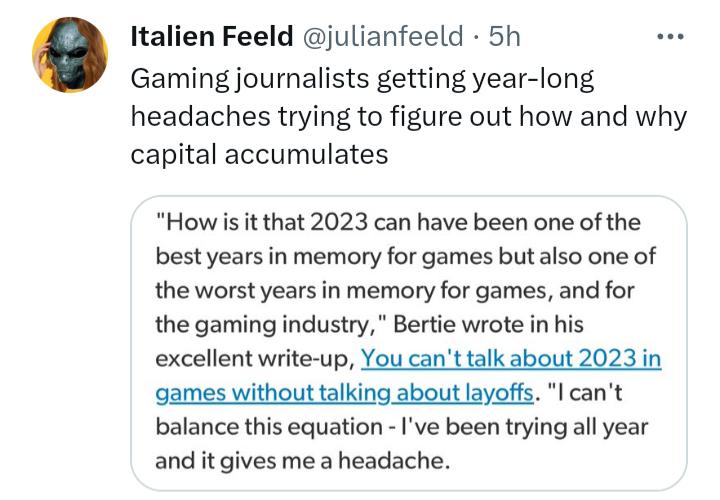

There is a legitimate point of contradiction in the minds of the professional class, as they assume that they are adding value to their firms and are therefore entitled to a share of that value in wages.

They don't see the value of investment dollars or the cult-psychology of the C-levels who consider labor purely a liability. They see their work as productive and meaningful, at least to the company's bottom line. And so when they generate a bunch of new value only to have their jobs terminated before they can reap a payout, they're confused and frustrated by the seemingly illogical nature of the decision.

But then they all go back out and seek other jobs at lower salaries, with fewer benefits, and under harsher labor conditions. They end up working for another set of businesses who all got credit from the same folks that rewarded their last set of employers with new investment for layoffs. And they go through the same cycle of productive labor -> constrained payout -> early dismissal, never really putting the pieces together because its all obscured at the highest levels of financialization.

A lot of this is the result of Econ 101 level propaganda. A lot of this is the fetishization of commodities and the magical realism of financialization. A lot of this is people simply not having the brain-space to draw conclusions from individual life-experiences ten years removed from one another. I don't begrudge folks for missing how the three-card monte of wage labor works, because its a difficult trick to follow. But, at some point, you can't argue with the results. They're getting more revenue and you're getting less pay over time. You don't need to follow the card to know the game is rigged.

actually I'm part of a different class immune to the predations of capital

actually I'm part of a different class immune to the predations of capital

FOSS

FOSS THEFT

THEFT