Gaslighting? Did you read the article? It doesn’t say that the economy is fine. It’s about how social media makes people feel shitty about how much money they (don’t) have, because they see so many people living glamorous lives online.

News

Welcome to the News community!

Rules:

1. Be civil

Attack the argument, not the person. No racism/sexism/bigotry. Good faith argumentation only. This includes accusing another user of being a bot or paid actor. Trolling is uncivil and is grounds for removal and/or a community ban. Do not respond to rule-breaking content; report it and move on.

2. All posts should contain a source (url) that is as reliable and unbiased as possible and must only contain one link.

Obvious right or left wing sources will be removed at the mods discretion. We have an actively updated blocklist, which you can see here: https://lemmy.world/post/2246130 if you feel like any website is missing, contact the mods. Supporting links can be added in comments or posted seperately but not to the post body.

3. No bots, spam or self-promotion.

Only approved bots, which follow the guidelines for bots set by the instance, are allowed.

4. Post titles should be the same as the article used as source.

Posts which titles don’t match the source won’t be removed, but the autoMod will notify you, and if your title misrepresents the original article, the post will be deleted. If the site changed their headline, the bot might still contact you, just ignore it, we won’t delete your post.

5. Only recent news is allowed.

Posts must be news from the most recent 30 days.

6. All posts must be news articles.

No opinion pieces, Listicles, editorials or celebrity gossip is allowed. All posts will be judged on a case-by-case basis.

7. No duplicate posts.

If a source you used was already posted by someone else, the autoMod will leave a message. Please remove your post if the autoMod is correct. If the post that matches your post is very old, we refer you to rule 5.

8. Misinformation is prohibited.

Misinformation / propaganda is strictly prohibited. Any comment or post containing or linking to misinformation will be removed. If you feel that your post has been removed in error, credible sources must be provided.

9. No link shorteners.

The auto mod will contact you if a link shortener is detected, please delete your post if they are right.

10. Don't copy entire article in your post body

For copyright reasons, you are not allowed to copy an entire article into your post body. This is an instance wide rule, that is strictly enforced in this community.

Roughly 43% of Gen Z and 41% of millennials struggle with comparisons to others and feel behind financially

This is the kind of attribution they are making, that its just a psychological condition and not an actual endemic issue that needs to be addressed.

I can definitely see why the term "gaslighting" was used

"Sir, 50% of the population has this virus called COVID."

"It's just a virology condition and not an actual endemic issue that needs to be addressed."

To know how endemic it is to younger gens, we would need a baseline and to know the prevalence in prior gens.

I suspect that the progression of social media and influencers has amplified a false lifestyle perspective — the same as tv and ads/consumerism would've amplified them for prior gens — but I haven't seen any large cross sectional or generational studies; only ones that are, at best, anecdotal.

Purchasing power of different generations tells you everything you need to know - there's zero ambiguity in this - things have objectively got far worse and far more unequal since the 70's.

It also says that people are doing far better than they think according to those who actually service these customers.

Well I'm not young but I haven't been able to afford to go to the dentist in twenty years so I'd say that's quantifiably shitty.

Our entire economic system is out of balance, debt is rampant in the midst of late-stage capitalism, and they come up with the term "money dysmorphia". 🤡

newspeak

Its balanced exactly as the owner class wants: conveying all wealth and value into their coffers.

We pretend its broken, but its doing exactly what the elites want it to.

You're not getting paid too little, you are just money dysmorphic, get back to work

It has to be either or. There can't possibly be multiple factors in play at the same time.

There are definitely multiple factors.

But money dysmorphia isn’t one of them.

This is a muddled message. Are we caught up chasing an illusion, or are we just more acutely aware of our poor condition?

It reads like it is saying the former, but then quotes statistics that reflect real loss of buying power. On the coasts 100k is no longer a large income. People really do live paycheck to paycheck while carefully managing their spending.

I'm inclined to at least partially acknowledge the gaslighting comment as plausible.

Was it always the case that I would be turned down from multiple studio apartment complexes because I ONLY make ~100k a year? I cant afford spending the 2200 a month on rent and that being 33% or lower so I get denied. Has this always been the case or am I having money dismorphia? I'm only making 2X the median single income salary.

You aren't a trust fund kid, that's who's getting all the rentals.

Median roperty prices have increased more than 600% relative to median wages in the past 50 years where I'm from. Now, on 2 incomes, I'm trying to buy a modest apartment in that pumped market, and I'm bidding against downsizers and investors that were the beneficiaries of all that growth after buying a house that cost less than my deposit.

Now these motherfuckers call us lazy and gaslight us, saying everything is fine? Noah, fuck the boat - we're building guillotines.

I've just come to the conclusion I will never own anything new or at all really.

Don't give up yet, all it takes is a little billionaire blood on the street and things will change.

Only 14% of Americans consider themselves wealthy

Only 14%? I'm shocked it's that high!

I thought "Wealthy" was when the passive income of the money you already have, pays more than you typically spend.

Basically when you can "Live off the interest alone."

I thought “Wealthy” was when the passive income of the money you already have, pays more than you typically spend. Basically when you can “Live off the interest alone.”

I see your version of more of "Financial Independent". Aka "Fuck you money". At that level you don't need to work anymore for a decent life, but you're not living in what most would consider wealthy luxury. If you need a refresher on "fuck you money" I refer you to this primer (language warning).

"Wealthy" is when you have "Financial Independent", and you don't have to look at prices of anything before you buy it. At the lowest tier of "wealthy" $100 is like $1. To the highest tier, there is no likely object on Earth that is outside of their reach.

Someone please punch the writers for this shit.

I don't know why you're so upset at the article. Every time I compare myself to the Joneses I feel all sorts of inadequacy. /S

The issue is not with people feeling inadequate. The issue is fully with wealth inequality.

In fact, more than half of Americans earning more than $100,000 a year say they live paycheck to paycheck, another report by LendingClub found.

I think it'd be interesting to see what would happen if some states had personal finance classes in their curriculum and some didn't, see if there is a measurable impact down the line.

Personal finance classes probably would have a non-negligble impact on the people that just mindless spend and don't save for retirement etc.

But I would think also that the wildly inflated housing and child care costs and the inelastic demand between the two means just an unexpected health emergency or unanticipated home maintenance spending would leave a family in debt and living paycheck to paycheck until its paid off.

If you're making $100K you probably have a college degree and therefore student loans to pay as well.

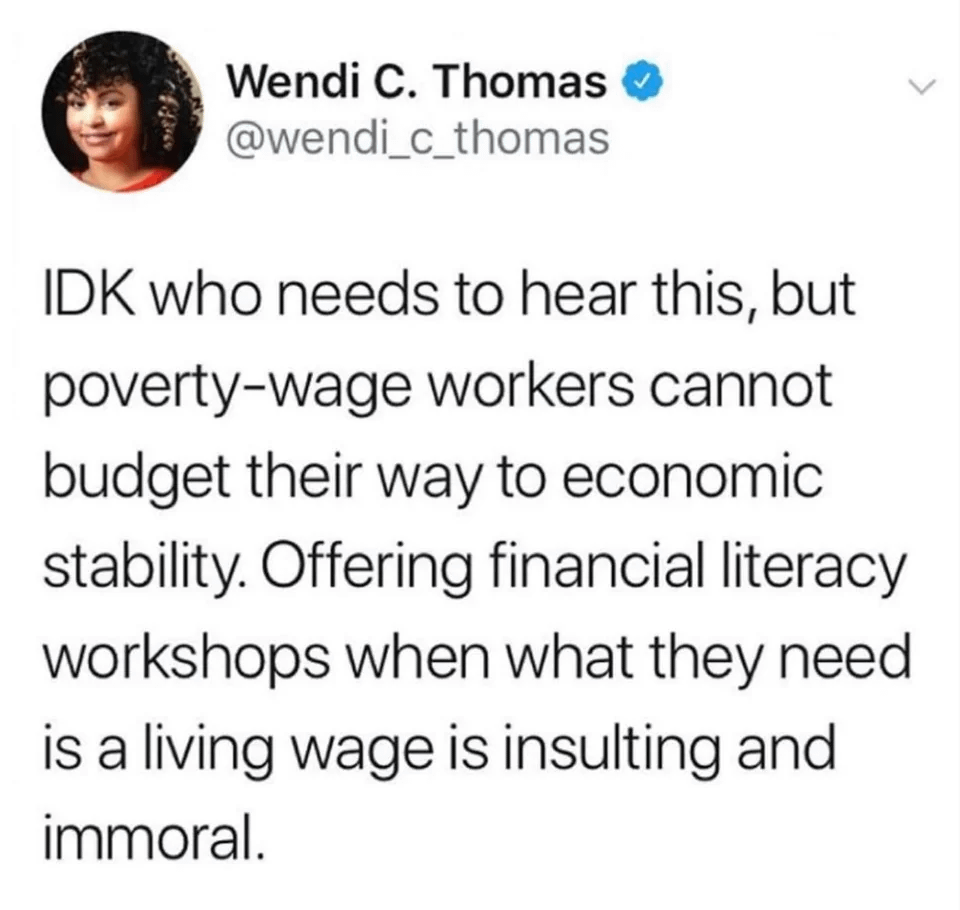

The problem isn't 40+ years of stagnant wages and corporate greed, it's because people need classes on how to be poor correctly.

That's how you sound right now.

Well, my own observation shows me that most people don't know the first thing about basic finances: compounding interest, budgeting, critical thinking when seeing advertisements, and the cost of take-out vs making dinner are some examples.

For gods sakes, check your credit card and bank balances once in a while!. smh.

I count myself blessed for having earlier made the realization that I value financial security way more than the shiny new thing. What I also realized that often it's not the shiny new thing where all my money goes to but it's the repeating expenses from that daily starbucks coffee to groceries and utilities. If you find a way to save there it'll start accumulating quickly.

That's a big if.

A huge percentage of Americans (my family included) live paycheck-to-paycheck. There's little or nothing left to save. They have everything from student loans to medical debts.

Criticizing someone for spending a few dollars a day on coffee to make their life a little more bearable is placing the criticism on the wrong party. You should be angry that anyone should have to make such unnecessary sacrifices. You should be angry that we can't all get the shiny new thing if we want it.

Rightwing scum will do anything except admit their system doesn't work.

Are we still complaining about Starbucks? Let's call it $7 for a coffee. That comes to about $2555 a year. Sounds like a lot of money.

Say I wanted to buy a house. The median home price in the start of 2020 was $329000. End of 2023, it was $417,700 (down from its peak). An increase of $88,700. Assuming a down payment of 20%, your median down payment went up buy $17,740. Almost 7 years worth of Starbucks. In just 3 years.

But wait. Interest rates also changed. Assuming the same %20 down payment, your principle increased by $70,960. The 30 year mortgage over that time went up from around %3.72 to %6.66. An increase of about %2.9. The increased interest on the increased principle is about $2,057; so I guess your Starbucks habbit would cover that.

Of course, that is a strange metric. You pay the full %6.66 on the increased principle. The %2.9 is the additional interest you pay on the original principle. So your annual interest payments went up by $12,358 just for delaying your purchase by 3 years. If you cut off your 4.8 starbucks coffees a day addiction, you'll be able to afford this increase.

Hey, you do you. If $2555 isn't a lot of money to you then you're in the 0.1% of people. Most of us aren't in a privlidged position like that so being able to cut down in repeating small expenses like that is going to have a massive effect on our personal finances. 2.5k is about what I earn in a month. I like coffee too but not so much that I'd be willing to work for a month to pay for it. That amount of money covers my groceries for 4 months. Seems like better value for my money.

Overwhelming evidence suggests social media has a negative effect on self-esteem.

That's all they really need to say - it will clearly have an impact on how people perceive their own looks and lifestyle when they're likely doing fine. I'm not sure they need to invent a new phrase to describe it.

gestures rudely at "writers" behind this

I believe the article. My junior coworkers that are young fresh out of college grads landing 100k salary feel behind. Median us household income is like 78k. The article is about the psychological impact. Although I don't doubt that there's people struggling and inflation and wage stagnation are real, I think we shouldn't doubt that what this article describes as money dysmorphia isn't also real.

Yeah there are people who earn a lot but are absolutely shit at managing their income. No wonder large chunk of them are also influenced by what they see on social media.

Ah so I only think I can't buy something listed for $10 with only $5. Thanks for the tip. Gonna go put it into practice.